canadian tax strategies for high income earners

High income earners may find at some point in their career that RRSPs may leave too much wealth exposed to tax. Across all Canadians the average tax rate has hovered around the 15 to 20 range.

Many wealthy Canadians run a side business or their own business for the benefits of lower tax rates business write-offs and tax-deductible individual pension plans.

. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. Utilize RRSPs TFSAs RESPs to the max. Each plan defers or mitigates tax obligations in different ways.

Non-refundable tax credits offer substantial relief to some earners while refundable tax credits can reduce income tax to zero and provide refunds for others. Tax-sheltered accounts are extremely useful because they help you delay reduce or even avoid paying taxes all together. Income splitting and trusts.

Canadian dividends are a tax efficient source of investment income because they qualify for a special dividend tax credit which keeps the tax burden low. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount. Your RRSP limit for the current year 2018 is shown on your 2017 Notice of Assessment.

Tax Planning Strategies For High-Income Canadians Registered Education Savings Plan RESP. The Canadian tax system specifies tax rates for the various income levels and offers relief in the form of deductions and credits. Every Canadian has access to a few different tax-sheltered accounts to help them legally minimize their taxes.

As a refresher for 2021 fy the individual tax rates including medicare levy are. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The math is simple.

Canadian dividends are always taxed at lower rates than capital gains. Sell Inherited Real Estate. For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is.

Spousal Registered Retirement Savings Plan Spousal RRSP Flow-Through Shares. 50 Best Ways to Reduce Taxes for High Income Earners. While income splitting between family members may no longer be viable the new rules do not prevent higher income spouses from.

The government is not against helping tax payers minimize their tax bills legally. RRSP contributions are tax deductible and any income and gains earned inside a RRSP are not taxable. For example on the household level two income earners may combine their wages to afford a car.

Max Out Your Retirement Contributions. This has to generally be done within annual gift exclusions or loans. Income splitting with family members is a simple and effective tax planning strategy.

Using these accounts in the right. There are numerous tax avoidance strategies which take advantage of rules offer generous tax breaks and are not frowned upon or illegal. With interest income youre taxed at your marginal tax rate.

Employer-based accounts such as 401 k and 403 b accounts allow you. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep after-tax dollars in their hands versus more of their income going to the Canada Revenue Agency. Individuals making between 3000 to 24112 and families with incomes below 36482 are eligible for the tax credit.

RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will see the 500000 SBD threshold rolled back by 5 for every 1 of passive income earned inside the corporation in excess of 50000 per annum thereby exposing more business income to higher. If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates.

Canadian Tax Tricks. Tax planning for high. A great example of a safe tax-avoidance strategy is the RRSP Registered Retirement Savings Plans.

The contribution you will make will come straight out of your. Tax planning strategies for high-income earners. Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation.

In contrast the bottom 50 pays an income tax rate of roughly 5. One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Discover several strategies that make for a tax-smart wealth plan.

Female Percentage of High-Income Canadians. Income Distribution in Canada by Age. This is done through shady accounting practices or stashing money in offshore accounts in tax-havens like the Caribbean.

Make a contribution each year to your RRSP Registered Retirement Savings Plan to the maximum amount allowed ie. Tax Planning for High Income Canadians. Also if youre planning on being a high income earner in your retirement then an rrsp might not be as beneficial to you as youll still be taxed in a high tax bracket.

Look Into The Canada Workers Benefit CWB Formerly known as the Working Income Tax Benefit WITB the Canada Workers Benefit CWB is a refundable tax credit for Canadians with a low income. Lets start with retirement accounts. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans RESPs and Tax-Free Savings Accounts TFSAs.

The more money you make the more taxes you pay. If you run a business are self-employed or doing freelance and contract work its worth considering incorporation. If you need to pay for your childrens post-secondary education you should.

RRSP limit for the year. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

Therefor interest income is not the most tax-friendly investment. This is one of the most important tax strategies for you as a high-income earner. Canadas highest income earners those in the top 10 are paying effective tax rates of 25 to 40.

A 250 headline rate for non-trading income or also called passive income in the Irish tax code. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. 9 Ways for High Earners to Reduce Taxable Income 2022 1.

High Income Earners Need Specialized Advice Investment Executive

How Democrats Would Tax High Income Professionals Not Just The Mega Rich The New York Times

Pin On Advanced Financial Planning

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com

Tax Updates For High Income Earners In 2021

Disparity In Income Distribution In The Us Deloitte Insights

Smart Ways For High Income Earners To Contribute To Roth Iras

Proposed Tax Changes For High Income Individuals Ey Us

5 Tax Efficient Portfolio Tips For High Income Earners Invest Correctly

How Do Taxes Affect Income Inequality Tax Policy Center

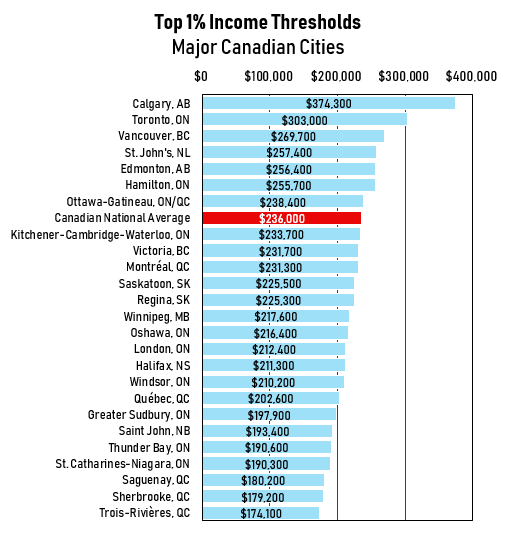

High Income Canadians Data On How Much They Earn Pay In Taxes Income Inequality And What It Means To Be A One Percenter In Different Cities Provinces Across The Country R Personalfinancecanada

How Do Taxes Affect Income Inequality Tax Policy Center

Financial Sentiment Among Income Groups Deloitte Insights

Tax Planning For High Income Canadians